Outpacing Change

Building a competitive advantage in unprecedented times.

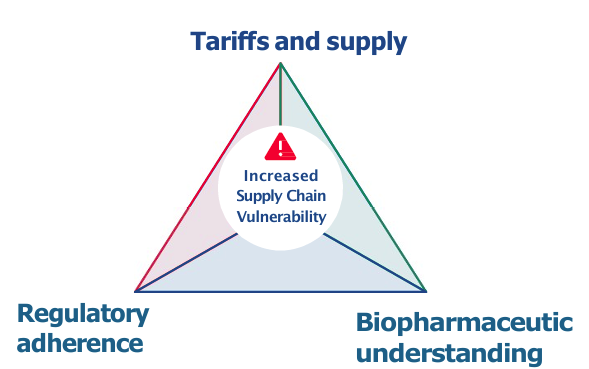

Geopolitical volatility/tariffs

Trade tensions are greatly impacting existing supply networks for API procurement and making assurance of supply at a commercially viable price a significant challenge.

Technical capabilities

- Biopharmaceutical Analysis

- Strategic API Supplier Management

- Supply Chain Risk Assessment

Enhance Resilience

Faster Recovery

Significantly reduce supply chain disruption impact and restoration time through improved biopharmaceutical understanding.

Competitive Advantage

Market Share Protection

Maintain market position during disruptions while competitors face prolonged supply chain challenges.

Biopharmaceutics understanding is critical. Here's why

- Poorly soluble compounds often require complex formulation and manufacturing processes to ensure reproducible bioavailability.

- Heightened sensitivity to manufacturing variability leads to increased regulatory scrutiny.

- Complex bioequivalence requirements create significant barriers to rapid supplier changes.

When API supply chains are disrupted, BCS Class II drugs face the longest time-to-restoration due to complex bioequivalence requirements. This creates disproportionate impact on healthcare systems and economic value.

The definitive data on which this classification is based is often not available, resulting in incorrect assumptions.

High permeability

High permeability

Low permeability

Low permeability

Significant Impact

The impact of poor biopharmaceutical understanding

Higher Losses

BCS Class II disruptions cause 2–3× greater revenue loss due to complex reformulation and extended timelines.

Supplier Diversification Challenges

Many suppliers require revalidation (12–24 months) when changes are needed, delaying supply restoration.

Regulatory Requirements

Markets have divergent bioequivalence requirements, creating costly redundancies and delays therefore impacting market share.

Key Implications

Patient impact

Essential medicines stockouts directly impact patient care and health outcomes.

Market impact

Competitors gain permanent market share during extended outages, creating long-term business consequences.

Strategic opportunity

Proactive biopharmaceutical understanding creates competitive advantage and resilience against disruptions.

How We Can Add Value

Biopharmaceutical analysis and how it ties in to your supply chain decision making.

Enhanced Resilience

Significantly reduce supply chain disruption impact and restoration time through improved biopharmaceutical understanding.

Regulatory Predictability

Navigate the complex regulatory landscape with confidence through our expertise in divergent bioequivalence requirements.

Competitive Advantage

Maintain market share during disruptions while competitors face prolonged supply chain challenges.

Is Your Current Portfolio at Risk?

Identify vulnerabilities and explore how Greengates Bio can help you build resilience.

- Comprehensive BCS Class II vulnerability analysis

- API supplier diversification strategy

Talk to Our Experts

We’re here to help you reduce risk and grow value. Send us a message and we’ll get back to you soon.